Thinking about setting up a UAE Holding Company? It’s a smart move for managing assets and streamlining operations. This guide breaks down what you need to know about these structures in the UAE. We’ll cover the basics, the different types available, and what rules you’ll need to follow. It’s not super complicated, but you do need to get the details right.

Understanding UAE Holding Companies

So, what exactly is a holding company, especially when we’re talking about the UAE? Think of it as a parent company. Its main job isn’t to make widgets or offer services directly, but rather to own shares in other companies, which we call subsidiaries. This setup is pretty common for businesses looking to manage a group of companies, protect assets, and plan their finances more effectively. It’s a key structure for investing in UAE companies and setting up a holding entity in the Emirates.

What is a Holding Company?

A holding company is essentially a business entity whose primary function is to hold controlling interests in other companies. It doesn’t usually get involved in the day-to-day operations of these subsidiaries. Instead, it oversees them, manages investments, and often centralizes functions like finance or strategy. This structure is a popular choice for managing diverse business portfolios and can be a smart move for Abu Dhabi business setup requirements.

Key Benefits of Establishing a Holding Company in the UAE

Setting up a holding company in the UAE comes with a bunch of advantages. For starters, you get limited liability. This means your personal assets are generally protected if one of the subsidiary companies runs into trouble. It’s a big deal for risk management.

Here are some of the main perks:

- Asset Protection: By separating assets into different legal entities, a holding company structure helps shield them from the operational risks of individual subsidiaries. This is a core part of Emirati corporate governance laws.

- Tax Efficiency: The UAE has a very favorable tax environment. While specific rules can apply, generally, there’s no personal income tax, and corporate taxes are low. Holding companies can also take advantage of the UAE’s network of Double Taxation Avoidance Agreements.

- Centralized Management: You can manage multiple businesses from one central point. This makes strategic decision-making easier and can improve overall operational efficiency across your group.

- Investment Vehicle: It’s a great way to manage various investments and business interests under one umbrella, simplifying ownership and control.

The UAE offers a robust legal framework that supports the establishment and operation of holding companies. Understanding the specific dubai holding company regulations and federal laws is key to successful setup and ongoing compliance. This structure allows for strategic growth and effective management of diverse business interests within the Emirates.

Types of Holding Companies in the UAE

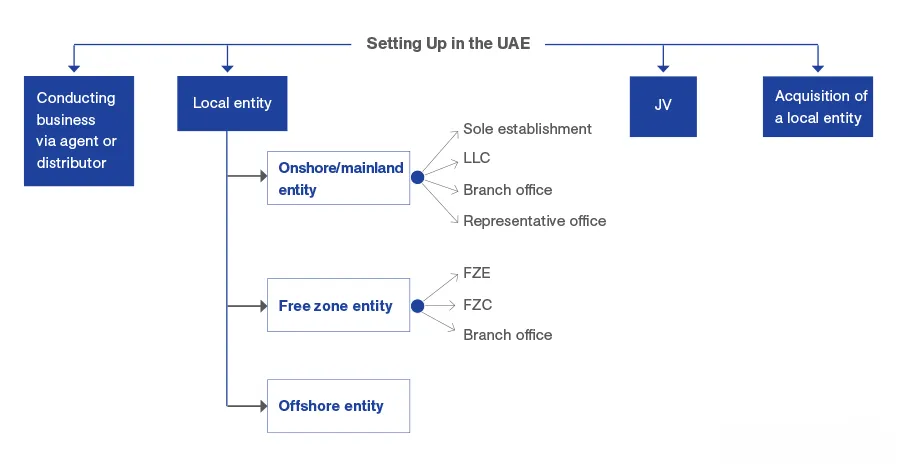

When you’re looking at setting up a holding company in the UAE, you’ll find there are two main paths you can take: onshore (mainland) and offshore (free zones). Each has its own set of rules and benefits, so it really depends on what you’re trying to achieve with your business structure.

Onshore Holding Companies (Mainland)

Setting up an onshore holding company means your business will be registered directly with the Department of Economic Development (DED) in the relevant emirate, like Dubai or Abu Dhabi. This gives you direct access to the UAE market. Think of it as being fully integrated into the local economy. You can conduct business activities directly within the UAE and engage with local customers and suppliers without many restrictions. This is often done through a Limited Liability Company (LLC) structure. It’s a solid choice if your primary focus is on operating within the UAE itself, perhaps managing a portfolio of local businesses or investments. You get the advantage of 100% foreign ownership in many cases, which is a big plus. It’s a bit more involved in terms of initial setup compared to some offshore options, but the payoff is direct market participation.

Offshore Holding Companies (Free Zones)

Now, offshore holding companies are typically established within one of the UAE’s many free zones. These zones, like Jebel Ali Free Zone (JAFZA) or Dubai Multi Commodities Centre (DMCC), are special economic areas that operate under their own set of regulations, often designed to attract foreign investment. Setting up here can be quicker and sometimes simpler. A big draw is that they often offer 100% foreign ownership and are exempt from certain local business requirements, like needing a local sponsor. These are great if your main goal is international business, asset protection, or managing investments across borders without necessarily needing a physical presence or direct engagement in the UAE market. They are really good for holding assets or shares in other companies, both within and outside the UAE. The setup process is usually streamlined, and they come with specific tax advantages and operational freedoms. You can find more details on setting up a holding company in Dubai mainland if that’s the route you’re considering.

Here’s a quick look at some key differences:

- Market Access: Mainland offers direct UAE market access; Free Zones are more for international operations or holding assets.

- Regulation: Mainland is regulated by the DED; Free Zones have their own governing authorities.

- Ownership: Both generally allow 100% foreign ownership, but the specifics can vary.

- Setup Complexity: Free Zones can sometimes be faster and simpler to set up.

Choosing between an onshore and offshore holding company really boils down to your business objectives. Are you looking to actively trade within the UAE, or is your focus more on international investments and asset management? The answer to that question will guide you toward the right structure.

Regulatory Framework and Compliance

Setting up and running a holding company in the UAE means you’ve got to play by the rules. It’s not just about picking a name and opening an office; there’s a whole system in place to make sure things are above board. This framework is pretty detailed, covering everything from who’s in charge to how you report your finances.

Key Regulatory Bodies and Laws

The UAE has several authorities keeping an eye on businesses. For holding companies, you’ll likely interact with the Department of Economic Development (DED) if you’re onshore, or the specific free zone authority where you’re registered. The Central Bank of the UAE also plays a role, especially if your holding company deals with financial activities. Plus, there’s the Federal Tax Authority (FTA) now that corporate tax is a thing. You’ve got to know the laws, like the Commercial Companies Law, and any specific regulations for your industry. It’s a lot to keep track of, honestly.

Licensing and Registration Requirements

Getting the right license is step one. Depending on whether your holding company is onshore or offshore, the process differs. Onshore companies usually need a commercial license from the DED, while free zone companies get their licenses from their respective free zone authorities. This involves submitting a bunch of documents, like your company’s Memorandum of Association, passport copies of shareholders and managers, and a business plan. It’s pretty standard stuff, but you need to get it right the first time to avoid delays. For example, setting up an LLC in Dubai in 2026 involves understanding legal, tax, and compliance requirements. Key steps include choosing the right license and securing office space.

Capital Requirements and Shareholding

There aren’t always strict minimum capital requirements for holding companies in the UAE, especially compared to some other jurisdictions. However, the amount of capital you state in your application needs to be realistic for the business activities you plan to undertake. Shareholding structures are also important. You’ll need to clearly define who owns what percentage of the company. This information, along with details about the ultimate beneficial owners (UBOs), needs to be maintained and updated. The UAE has regulations in place, like the UBO regulations, requiring companies to keep registers of shareholders and beneficial owners, with any changes needing to be reported within 15 days.

Keeping up with all these regulations can feel like a full-time job. It’s not just about the initial setup; it’s an ongoing commitment to stay compliant. Missing deadlines or failing to report changes can lead to fines and other penalties, which nobody wants.

Here’s a quick rundown of some compliance areas:

- Audits: Most companies, including holding companies, need to have their financial accounts audited annually by a licensed auditor. Free zone companies might have slightly different timelines for submitting these reports.

- Economic Substance Regulations (ESR): If your holding company engages in specific ‘relevant activities’, you need to demonstrate adequate economic presence in the UAE. This involves meeting certain tests related to your core income-generating activities.

- Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF): You need to implement procedures to prevent financial crime. This includes customer due diligence (KYC) and reporting suspicious transactions to the relevant authorities.

- Corporate Tax: Since June 2023, a 9% corporate tax applies to taxable profits exceeding AED 375,000. Holding companies need to understand how this applies to their income and structure their affairs accordingly.

Taxation and Financial Obligations

When you set up a holding company in the UAE, you’ll run into a few financial and tax things you need to sort out. It’s not super complicated, but you definitely don’t want to miss anything.

First off, there’s the corporate tax. Since June 2023, the UAE has a standard corporate tax rate of 9%. This applies to taxable profits that go over AED 375,000. So, if your holding company makes a good chunk of money, you’ll need to account for this. It’s important to keep good records to figure out exactly what’s taxable.

Then there’s Value Added Tax, or VAT. The standard rate is 5%, and it kicked in back in January 2018. You have to register for VAT if your taxable supplies and imports go above AED 375,000 in a year. There’s also an optional registration threshold if your supplies are over AED 187,500. You’ll need to file VAT returns, usually monthly or quarterly, and pay on time to avoid any fines.

Keeping accurate financial records is key. This helps you figure out your tax liabilities correctly and makes sure you’re ready for any audits or reporting requirements. It’s not just about paying taxes; it’s about showing you’re running your business properly.

Beyond taxes, you’ve got to think about Anti-Money Laundering (AML) rules. These are in place to keep the financial system clean. While they might seem more focused on banks and other financial outfits, businesses that deal with certain things, like real estate agents or dealers in precious metals, also have obligations. This usually involves knowing who your clients are and reporting anything that looks fishy. For holding companies, it’s about making sure the money flowing through your subsidiaries is legitimate.

Finally, remember that audits are often a requirement. Mainland companies usually need their accounts audited by a licensed auditor and must keep records for at least five years. Free zone companies might have slightly different timelines, but the idea is the same – have your financials checked and keep them safe.

Ongoing Compliance and Reporting

So, you’ve got your holding company set up in the UAE, which is great. But the work doesn’t stop there, not by a long shot. Keeping things compliant and reporting properly is a big part of running the show, and honestly, it can get a bit detailed.

First off, think about your financial audits. Most holding companies, especially those on the mainland, need to have their books checked by a licensed auditor every year. Free zone companies might have slightly different timelines, sometimes tied to their license renewal, but the audit is still a thing. You’ve got to keep good financial records, too usually for at least five years. It’s not just about avoiding trouble; it shows you’re running a solid operation.

Then there’s the Economic Substance Regulation (ESR). If your holding company does certain types of business, like managing investments or holding intellectual property, you need to prove you’re actually doing business here and not just a shell. This involves meeting specific tests to show adequate economic presence. You’ll need to file annual notifications and reports for this, detailing your activities and income.

Don’t forget about the Ultimate Beneficial Owner (UBO) rules. You have to keep a register of who really owns and controls the company. Any changes to this need to be reported pretty quickly, usually within 15 days. It’s all about transparency, making sure everyone knows who’s behind the company.

And of course, there’s corporate tax. Since June 2023, there’s a 9% tax on profits over AED 375,000. You’ll need to file tax returns and make sure you’re paying what you owe. For VAT, if you’re over the threshold, you’ll be filing returns regularly, usually monthly or quarterly.

Finally, keep an eye on Anti-Money Laundering (AML) regulations. Depending on your activities, you might need to implement strict customer due diligence and report any suspicious transactions. This applies to financial institutions and certain other businesses too.

Staying on top of these requirements means dedicating resources to compliance. It’s not just a box-ticking exercise; it’s about building trust and ensuring the long-term stability of your holding company within the UAE’s business environment.

Staying on top of rules and sending in your reports is super important. We make sure you know exactly what needs to be done and when. Don’t let compliance worries slow you down. Visit our website to learn how we can help you manage all your ongoing reporting needs smoothly.

Why Choose Ripple Business Setup for UAE Holding Company Formation

Setting up a holding company in the UAE involves legal planning, compliance checks, and the right licensing structure. Ripple Business Setup helps investors choose the best jurisdiction, mainland or free zone, based on ownership goals and tax efficiency. Our team guides you through company registration, documentation, regulatory approvals, and ongoing compliance. We also assist with corporate structuring, bank account support, and reporting requirements so your holding company stays fully compliant with UAE regulations.

For expert support, contact Ripple Business Setup at +971 50 593 8101, email info@ripplellc.ae, or WhatsApp +971 4 250 0833.

Wrapping It Up

So, setting up a holding company in the UAE is definitely a smart move for a lot of businesses. It can really help with protecting your assets and managing things more smoothly. But, and it’s a big ‘but’, you can’t just wing it. There are rules, like the corporate tax and the economic substance stuff, that you absolutely have to get right. Plus, understanding how things work locally is key. It’s not just about the paperwork; it’s about making sure your company fits into the UAE business scene. If you’re feeling a bit overwhelmed by all the details, getting some professional help is probably a good idea. They can help you sort out the legal bits and make sure you’re following all the regulations so you can focus on growing your business.

Frequently Asked Questions

What exactly is a holding company?

Think of a holding company like a parent company. Its main job is to own other companies, which are called subsidiaries. Instead of making products or offering services itself, it manages and controls these other businesses. It’s a way to keep different parts of a business separate and organized.

Why would someone want to set up a holding company in the UAE?

Setting up a holding company in the UAE is popular because it offers great benefits. You get protection for your personal stuff if the company has problems (that’s called limited liability). The UAE also has very low taxes, which can save you a lot of money. Plus, it makes it easier to manage all your different businesses from one place.

Are there different kinds of holding companies in the UAE?

Yes, there are! You can have a holding company on the mainland, which is part of the UAE’s regular business system. Or, you can set one up in a free zone, which is a special area with its own rules and often offers more benefits for international businesses. Each has its own advantages depending on what you want to do.

What are the rules for setting up a holding company?

To set one up, you’ll need to follow specific steps. This includes choosing a good company name that fits the rules, getting the right licenses, and setting up the company’s internal rules (like its bylaws). You also need to make sure you have enough money to start, though often there isn’t a strict minimum amount required.

Do holding companies have to pay taxes in the UAE?

The UAE has a new corporate tax, which is 9% on profits over a certain amount. While the UAE is known for being tax-friendly, holding companies still need to follow the rules. This means registering for tax, filing reports on time, and understanding how taxes work for your specific business structure.

What kind of ongoing tasks do holding companies need to do?

Holding companies must keep their records clean and follow all the rules. This includes things like making sure you know who the real owners are (called Ultimate Beneficial Owners) and reporting any changes quickly. You also need to get your company’s financial accounts checked by an auditor every year.

Disclaimer: This content is for general information only and does not replace professional legal or financial advice. Regulations may change, so always confirm requirements with qualified consultants or relevant UAE authorities before making decisions.