Thinking about starting your own business in Abu Dhabi? A sole proprietorship might be just the ticket. It’s a straightforward way to get your venture off the ground as a single owner. This guide is here to break down what a sole proprietorship in Abu Dhabi actually is, why it could be a good fit for you, and what you need to know about getting that all-important license and the associated fees. We’ll cover the steps involved, the documents you’ll need, and what happens after you’re up and running.

What is a Sole Proprietorship in Abu Dhabi?

So, you’re thinking about starting a business in Abu Dhabi and want to go it alone? A sole proprietorship might be just the ticket. Basically, it’s a business owned and run by one person, and there’s no legal distinction between you and your business. This means you are the business, and the business is you. It’s a really straightforward way of setting up shop, especially if you’re just starting out or have a specific service to offer. It’s a popular choice for many entrepreneurs looking into business setup Abu Dhabi because it offers complete control.

When you set up a sole proprietorship, you’re essentially the boss of everything. You make all the decisions, you keep all the profits, and you’re also responsible for all the debts and liabilities. This unlimited liability is a big point to consider it means your personal assets could be on the line if the business runs into financial trouble. It’s a trade-off for the simplicity and full ownership you get.

Here’s a quick rundown of what that looks like:

- Single Owner: You are the only owner.

- Unlimited Liability: Your personal assets are not separate from business debts.

- Direct Control: You have 100% say in how the business is run.

- Profit Retention: All profits are yours to keep.

This structure is often the first step for many individuals interested in starting a business in Abu Dhabi. It’s a common path for professionals offering services, like consultants, designers, or tradespeople, who want to operate as an independent entity. For those wondering about how to start a business alone in Abu Dhabi, this is often the most direct route. It’s also a viable option for setting up a single-person company in Abu Dhabi or setting up a sole trader in UAE if you meet the residency or nationality requirements.

The appeal of a sole proprietorship lies in its simplicity. It cuts down on the administrative hurdles and allows you to focus more on your actual work rather than complex legal structures. It’s a way to get your ideas off the ground quickly and efficiently.

Benefits of Setting Up a Sole Proprietorship

Starting a sole proprietorship in Abu Dhabi comes with some pretty sweet advantages, especially if you’re just getting your feet wet in the business world or want to keep things simple. It’s a popular choice for a reason, and here’s why.

Full Control and Ownership

This is a big one. When you’re a sole proprietor, you are the boss, plain and simple. Every decision, big or small, rests with you. You don’t have to run ideas past partners or wait for a board meeting. This means you can pivot quickly if you see an opportunity or need to change direction. Plus, all the profits your business makes? They’re all yours. No splitting with shareholders or partners. It’s your hard work, your reward.

Simplicity in Setup and Management

Compared to other business structures, setting up a sole proprietorship is generally less complicated and often costs less to get off the ground. The paperwork is usually more straightforward, and you don’t have the same level of administrative burden as a larger company. This means you can spend less time on bureaucracy and more time actually running your business and serving your customers. It’s a great way to get started without getting bogged down in complex legalities.

Direct Profit Retention

As mentioned, all the money your business earns goes directly to you. This makes financial planning and reinvestment much simpler. If you have a great month, you see the direct benefit. This can be a huge motivator and allows for quicker growth if you choose to reinvest those profits back into the business. It’s a very direct link between your effort and your financial gain.

The straightforward nature of a sole proprietorship means you can focus your energy on growing your venture rather than getting lost in corporate structures. This directness is a major draw for many entrepreneurs.

Here’s a quick rundown of why it’s appealing:

- Complete Authority: You call all the shots.

- All Profits: Every dirham earned is yours.

- Lower Startup Hurdles: Generally easier and cheaper to begin.

- Flexibility: Adapt your business as needed without lengthy approvals.

Setting up a business in the UAE can be a rewarding experience, and a sole proprietorship offers a clear path for many. Understanding the benefits is the first step in deciding if this structure is the right fit for your entrepreneurial journey. If you’re looking into setting up a company in the UAE, weighing these advantages is key.

Requirements for Establishing a Sole Proprietorship

So, you’re thinking about going solo with your business in Abu Dhabi? That’s awesome! But before you start dreaming about all the profits, let’s talk about what you actually need to get this whole thing off the ground. It’s not super complicated, but you do need to have a few things in order.

Eligibility Criteria

First off, who can even start a sole proprietorship here? Generally, Abu Dhabi nationals and citizens of other Gulf Cooperation Council (GCC) countries can set up a sole proprietorship without any major hurdles. For folks from outside the GCC, it’s also totally possible, but there’s a catch. You’ll likely need to appoint a National Service Agent (NSA). This is basically a UAE national who helps you with the paperwork and official stuff, like getting licenses and visas. It’s a common setup for foreign business owners.

Remember, even though you’re the sole owner, you’re personally on the hook for all business debts. This means your personal assets aren’t really separate from the business’s. It’s a big responsibility, so make sure you’re ready for it.

Required Documents

Alright, paperwork time. While the exact list can shift a bit depending on what kind of business you’re running, here’s a rundown of the usual suspects you’ll need to gather:

- Passport Copy: A clear copy of your passport is a must. If you’re a resident, you’ll also need your UAE residence visa copy and Emirates ID.

- No Objection Certificate (NOC): If you’re currently employed and your visa is sponsored by your employer, you’ll need an NOC from them. This basically says they have no problem with you starting your own business.

- Proof of Qualifications: Depending on your business activity, you might need to show proof of your education, professional qualifications, or relevant experience. This is especially true for professional service businesses.

- Business Activity and Trade Name: You’ll need to decide on the specific activities your business will undertake and choose a unique trade name. You’ll need to get this name approved.

- Office Space Proof: If your business requires a physical location, you’ll need a lease agreement for your office space.

- Bank Reference Letter: Sometimes, a bank reference letter is requested to show your financial standing.

- Additional Approvals: For certain business activities, you might need special approvals from other government bodies. It’s good to check this early on.

Getting these documents sorted is a big step towards officially launching your venture. It might seem like a lot, but it’s all part of setting up a legitimate business in Abu Dhabi and choosing a business structure that works for you.

The Licensing Process in Abu Dhabi

So, you’ve decided a sole proprietorship is the way to go in Abu Dhabi. Great choice! Now, let’s talk about actually getting that Abu Dhabi trade license. It might seem a bit daunting, but breaking it down makes it much more manageable. The whole process is designed to get you up and running legally.

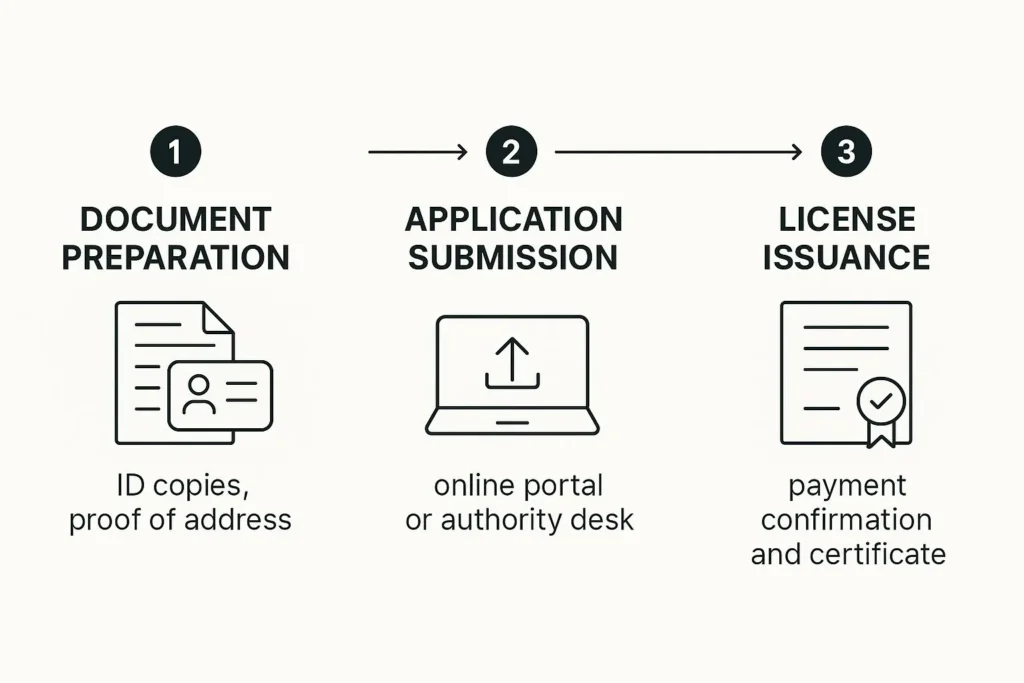

Here’s a general rundown of what you’ll likely go through for Abu Dhabi company registration:

- Pick Your Business Activity: First things first, you need to decide exactly what your business will do. The Department of Economic Development (DED) in Abu Dhabi has a list of approved activities. Your choice here is super important because it dictates the type of license you’ll need – commercial, professional, or industrial.

- Choose and Register Your Trade Name: Your business needs a unique name. It has to be professional, reflect your activity, and not be offensive. You’ll need to get this name approved by the DED before you can move forward.

- Get Initial Approval: This is like a green light from the authorities, saying your proposed business activity and legal structure are okay. It’s a necessary step before you gather all the final documents.

- Secure Office Space: You’ll need a physical address for your business. This could be a rented office space. You’ll need to provide a lease agreement as proof.

- Submit Your Application and Documents: This is where you gather everything. You’ll submit your application form along with all the required documents, like passport copies, Emirates ID (if you’re a resident), the initial approval letter, and your trade name certificate. If you’re a foreigner and need a Local Service Agent, that agreement will be part of this, too.

- Pay the Fees: Once your application is reviewed, you’ll be informed of the fees. Paying these fees is the final step before your license is issued. The costs can vary, so be prepared for that.

- Receive Your License: After everything is approved and paid for, congratulations! You’ll receive your official Abu Dhabi trade license, allowing you to operate legally.

Remember, while this outlines the general steps for registering a business in Abu Dhabi, specific requirements can sometimes shift. It’s always a good idea to check the latest guidelines from the DED or consult with a business setup professional to make sure you’ve got everything covered. This process is how you get your Abu Dhabi trade license.

It’s really about following the steps methodically. Don’t rush it, and make sure you have all your paperwork in order. This is how you get your business officially recognized and ready to trade.

Sole Proprietorship License Fees in Abu Dhabi

So, you’re thinking about setting up a sole proprietorship in Abu Dhabi? That’s great! Now, let’s talk about the money part, because nobody likes surprises when it comes to the cost of business setup in UAE.

The actual cost of getting your Abu Dhabi business license can really bounce around depending on what you’re doing and where you’re doing it. It’s not a one-size-fits-all deal, you know? But we can break down the typical expenses involved in Abu Dhabi business registration.

Here’s a general idea of what you might be looking at:

- Trade Name Reservation: This is usually a few hundred dirhams, maybe AED 620 to AED 800. It’s just to make sure your business name isn’t already taken.

- Initial Approval: Getting the green light from the Department of Economic Development (ADDED) can cost around AED 1,000 to AED 1,500.

- License Fees: This is the big one. The actual Abu Dhabi business license requirements dictate this fee, and it can range quite a bit. For a sole proprietorship, expect something in the ballpark of AED 3,000 to AED 7,000 annually. If you’re looking at a freelancer license Abu Dhabi, the costs might be structured a bit differently.

- Local Service Agent (LSA) Fees (for foreigners): If you’re not a UAE national, you’ll likely need an LSA. This can add a significant chunk, anywhere from AED 5,000 to AED 15,000 annually.

- Office Space Rental: This varies wildly based on location and size, but budget at least AED 10,000+ per year. You’ll need a tenancy contract for this.

- Municipality Fees: Often calculated as a percentage of your rent, so factor that in.

- Administrative Costs: Think about things like document attestation or legal translations, which might add another AED 1,000 to AED 2,000.

Keep in mind that these figures are estimates. The exact cost of business license in Abu Dhabi can change, and specific business activities might have unique fees or require additional permits from other government bodies. It’s always best to get a precise quote based on your specific business plan.

So, if you’re a UAE national, the total cost might be on the lower end, maybe AED 5,000 to AED 10,000 (not counting rent). For foreigners, with the LSA fees included, you’re probably looking at AED 10,000 to AED 20,000 or even more to get started. It’s a bit of an investment, but it gets you legally operating. Don’t forget about renewal fees down the line, too those licenses don’t last forever!

Ongoing Compliance and Renewals

So, you’ve got your sole proprietorship up and running in Abu Dhabi – that’s awesome! But hold on, it’s not quite a ‘set it and forget it’ situation. Keeping your business legit means staying on top of a few things, mainly making sure your license stays current and you’re following all the rules. It’s kind of like keeping your car registration up to date; you don’t want to get caught with an expired one, right?

Your business license isn’t a one-time thing. It has an expiry date, and you’ll need to renew it periodically. The exact renewal period can vary, but it’s usually annual. Missing the renewal deadline can lead to penalties, and nobody wants that. It’s best to mark your calendar or set up reminders well in advance. The process generally involves updating any business details that might have changed and paying the renewal fees. Think about it, if your business address changed or you added new services, you’ll need to reflect that.

Beyond just the license renewal, there’s the matter of ongoing compliance. This means making sure your business activities still align with the regulations set by Abu Dhabi authorities. For example, if you’re in a regulated industry like healthcare or tourism, you might have specific permits or standards to maintain. It’s also important to keep your business records tidy and be prepared for any potential inspections or inquiries. Staying compliant helps avoid fines and keeps your business operations smooth.

Here’s a quick rundown of what to keep in mind:

- License Renewal: Mark your calendar for renewal dates. Typically, this is an annual process.

- Update Business Information: Inform the authorities of any significant changes, like address, ownership, or business activities.

- Regulatory Adherence: Continuously follow the laws and regulations relevant to your specific business sector.

- Record Keeping: Maintain accurate and up-to-date business and financial records.

Keeping your business compliant isn’t just about avoiding trouble; it’s about building a solid foundation for long-term success. It shows professionalism and reliability to your clients and partners. Plus, it makes sure you can continue operating without any unexpected interruptions.

If you’re unsure about specific compliance requirements or the renewal process, it’s always a good idea to check with the relevant government departments or consult with a business setup professional. They can help you stay on the right track. For instance, if you’re looking into financial services, understanding the framework at Abu Dhabi Global Market is key.

Conclusion: Is a Sole Proprietorship Right for You?

So, you’ve looked into what it takes to set up a sole proprietorship in Abu Dhabi. It seems pretty straightforward, right? You get to be your own boss, keep all the profits, and the setup isn’t a huge headache. That’s definitely a big plus if you’re just starting out or have a clear vision for your business without needing partners.

But, and this is a pretty big ‘but’, you’ve got to remember that you’re personally on the hook for everything. All the business debts, all the legal stuff – it all comes back to you. There’s no corporate shield here. So, if your business idea involves a lot of risk, or you’re dealing with large sums of money or potentially complex contracts, you might want to think twice.

Here’s a quick rundown to help you decide:

- Full Control: You make all the decisions. No arguments with partners.

- Simplicity: Less paperwork and fewer regulations compared to other business types.

- Profit: All the money your business makes is yours.

- Unlimited Liability: This is the big one. Your personal assets are at risk if the business owes money or gets sued.

- Setup Time: Generally quicker, often around 2-4 weeks, but can vary.

- Capital: No minimum capital requirement, which is great for starting lean.

Think about your business idea. Is it something that’s relatively low-risk? Are you comfortable with the idea that your personal savings could be used to cover business debts? If you’re a freelancer, a consultant, or running a small service-based business where the risks are manageable, a sole proprietorship could be a fantastic fit. It lets you get going quickly and keep things simple.

However, if you’re planning something with significant financial exposure, or if you just want that extra layer of protection for your personal assets, it might be worth exploring other business structures like an LLC. It’s all about weighing the freedom and simplicity against the personal risk involved. Make sure you’re comfortable with the level of responsibility before you jump in.

So, is being a sole proprietor the right move for your business dreams? It’s a simple way to start, but it’s good to know all the details. If you’re ready to take the next step or want to learn more about different business structures, visit our website today!

Why Choose Ripple Business Setup for Sole Proprietorship in Abu Dhabi

Starting a sole proprietorship in Abu Dhabi involves multiple approvals, licensing steps, and cost planning. Ripple Business Setup helps simplify the entire process, from choosing the right business activity to obtaining your license and completing documentation. Our team supports trade name registration, government approvals, visa processing, and local service agent arrangements if required. With expert guidance, you can avoid delays and ensure your business is fully compliant with Abu Dhabi regulations.

For professional assistance, contact Ripple Business Setup at +971 50 593 8101, email info@ripplellc.ae, or WhatsApp +971 4 250 0833 to get step-by-step support for your company formation.

Wrapping Things Up

So, you’ve looked through all the details about starting a sole proprietorship in Abu Dhabi. It seems like a pretty solid option if you want to be your own boss and have full control. The process involves a few steps, like picking a business name and getting the right license, and there are some fees involved, but it’s generally straightforward. Remember, whether you’re a local or a foreigner needing a Local Service Agent, understanding these requirements is key. Abu Dhabi is definitely open for business, and setting up as a sole proprietor can be your first step into this dynamic market. Don’t hesitate to get professional help if it all feels a bit much it can make things go a lot smoother.

Frequently Asked Questions

Can someone from another country start a sole proprietorship in Abu Dhabi?

Yes, absolutely! Foreigners are welcome to start their own sole proprietorship businesses in Abu Dhabi. You might need to appoint a Local Service Agent (LSA) depending on the type of business, but it’s definitely possible.

Is it possible to set up a sole proprietorship in Abu Dhabi’s special economic zones (free zones)?

Yes, you can! Sole proprietorships can be established in Abu Dhabi’s free zones. Each free zone has its own set of rules, so it’s a good idea to check the specific regulations for the zone you’re interested in.

What happens if my business owes money? Am I responsible for it all?

With a sole proprietorship, you have unlimited liability. This means that if your business has debts or legal issues, your personal belongings could be used to pay them off. It’s important to be aware of this risk.

How long does it usually take to get a sole proprietorship business up and running in Abu Dhabi?

Typically, the whole process takes about 2 to 4 weeks. This can change a bit depending on how quickly you get all your papers ready and how fast the government approves everything.

Do I need a lot of money to start a sole proprietorship in Abu Dhabi?

Good news! There isn’t a set minimum amount of money you must have to start a sole proprietorship in Abu Dhabi. This makes it a more accessible option for many entrepreneurs.

What kind of documents will I likely need to provide?

You’ll generally need copies of your passport and UAE residence visa (if you have one), a trade name reservation certificate, and possibly a tenancy contract for your office space. If you’re sponsored by another company, you’ll also need a No Objection Certificate (NOC).

Disclaimer: The information provided in this article is for general guidance only. Business setup costs, license fees, and regulatory requirements in Abu Dhabi may change depending on government policies, business activity, and individual circumstances. Always consult a licensed business setup advisor or relevant authority before making financial or legal decisions.